Batteries and Learning Curves

Why we (almost) always get better at making things.

Amid the end-of-year news flurry, this incredible news update went largely unnoticed:

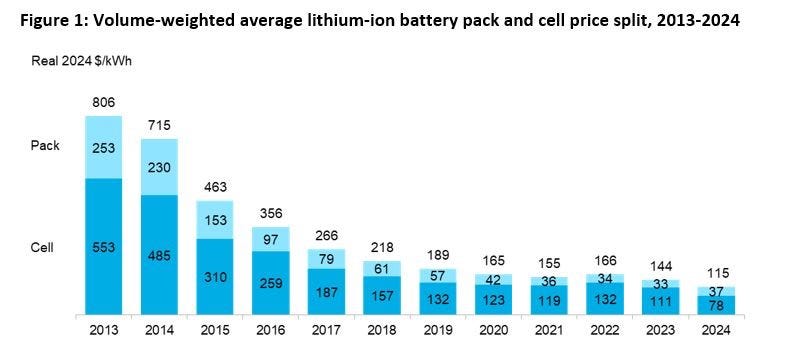

Since the early 2000s, lithium-ion battery prices have plummeted to levels previously thought to be impossible, captured in this chart by BloombergNEF:

An 86% reduction in price since 2013 is almost unbelievable. But why and how have battery prices fallen so consistently? Let’s examine the driving forces behind this monumental achievement and what this means for the future of electric vehicles (EVs) and energy storage.

Wright’s Law and learning curves

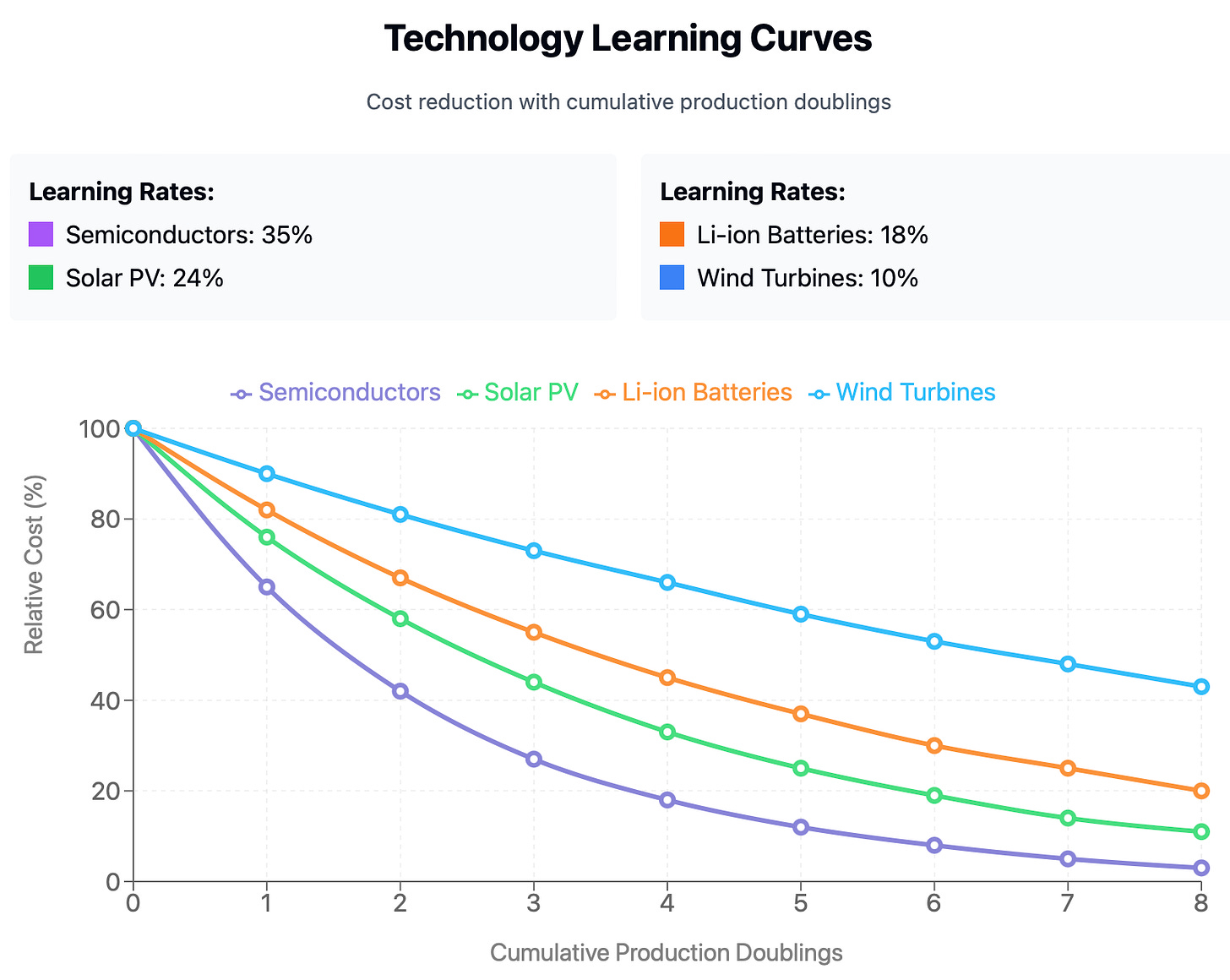

In 1936, aerospace engineer Theodore Wright observed that airplane production costs fell predictably as manufacturing volume increased. This gave rise to the concept of a manufacturing learning curve, which has proven to be prescient in predicting prices of different technologies over the years. Across sectors, analysts have observed that as production capacity doubles, prices typically fall by a consistent percentage. This relationship follows a power law:

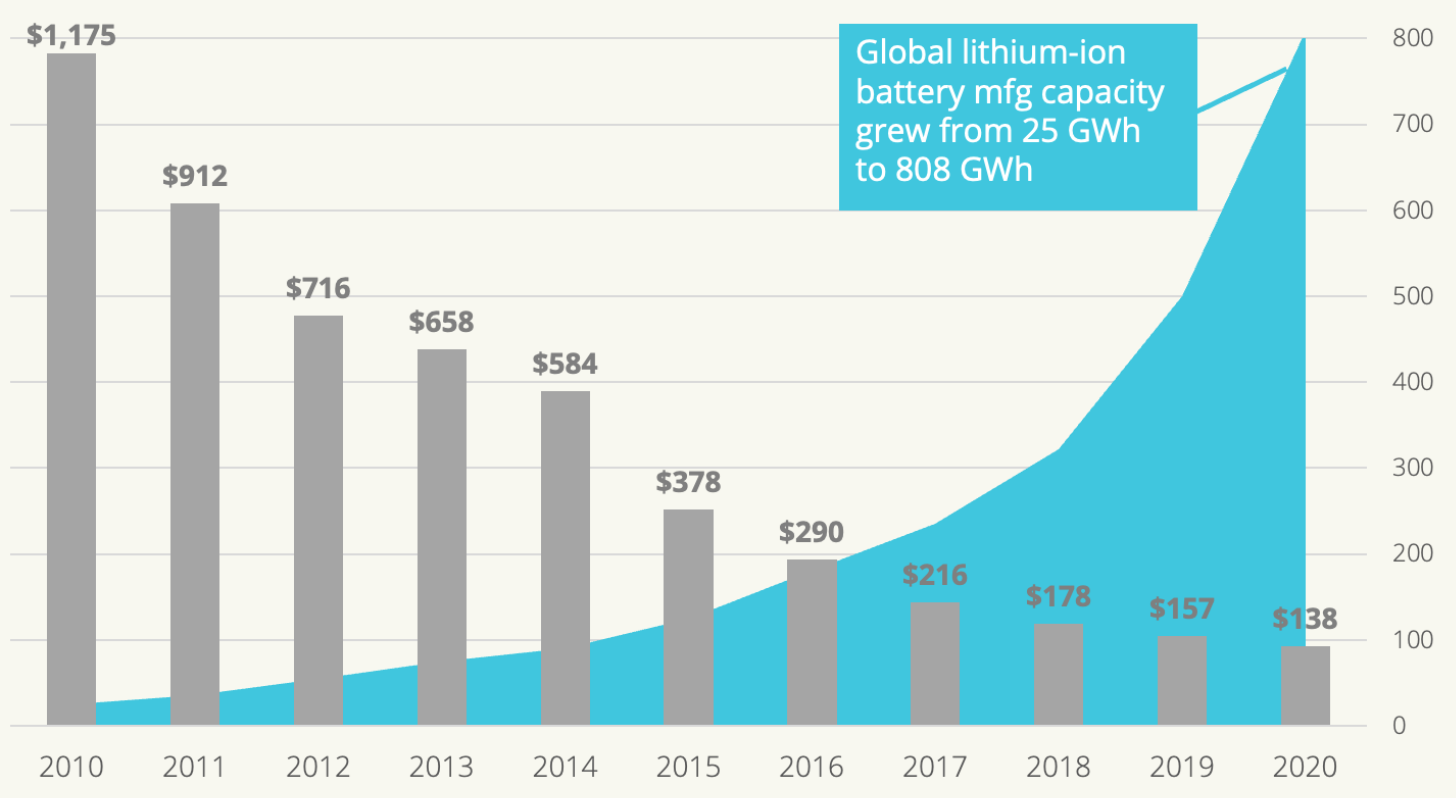

Here, n represents the number of production doublings. In the case of lithium-ion batteries, the observed historical learning rate since 2000 has been ~18%1. This means that for each doubling in production capacity, the price per kWh has fallen by 18% on average. Overlaying annual battery production totals with price on a chart gives us this:

To be clear, a learning curve is not a physical law and does not follow a predetermined engineering setup. The real world does not care for meeting the output of an arbitrary mathematical formula. Instead, think of a learning curve as an emergent property of a technology’s manufacturing framework, innovation, and scale. The sustained price decline of lithium-ion batteries has created a powerful positive feedback loop from which the learning curve emerges:

Lower prices → More applications become commercially feasible

More applications → Greater aggregate demand

Greater demand → Higher production volumes

Higher production volumes → Economies of scale and further learning

Further learning → Even lower prices

Here’s a chart I made to help visualise real-world learning rates across technologies:

We’re really good at making batteries (and really bad at predicting this)

Lithium-ion batteries have benefitted from three key factors that have catalysed its learning curve:

Manufacturing scale economies (learning-by-doing)

Improved raw material supply chains and prices

R&D and policy improvements

Today, over 95% of all manufactured lithium-ion batteries are dedicated to EVs2. The exponential rise in EV adoption led to massive production ramp-ups (like the Tesla & BYD gigafactories), reducing unit costs and improving process efficiencies. Constant advances in cell chemistry and design increased cell energy density and streamlined battery packs. This resulted in robust raw material supply chains as battery manufacturers looked to secure long-term purchase commitments. Finally, proactive government subsidies and tax incentives have helped increase EV adoption in China, Europe, and North America (although one might argue we no longer need aggressive policies given how cost-competitive EVs are today).

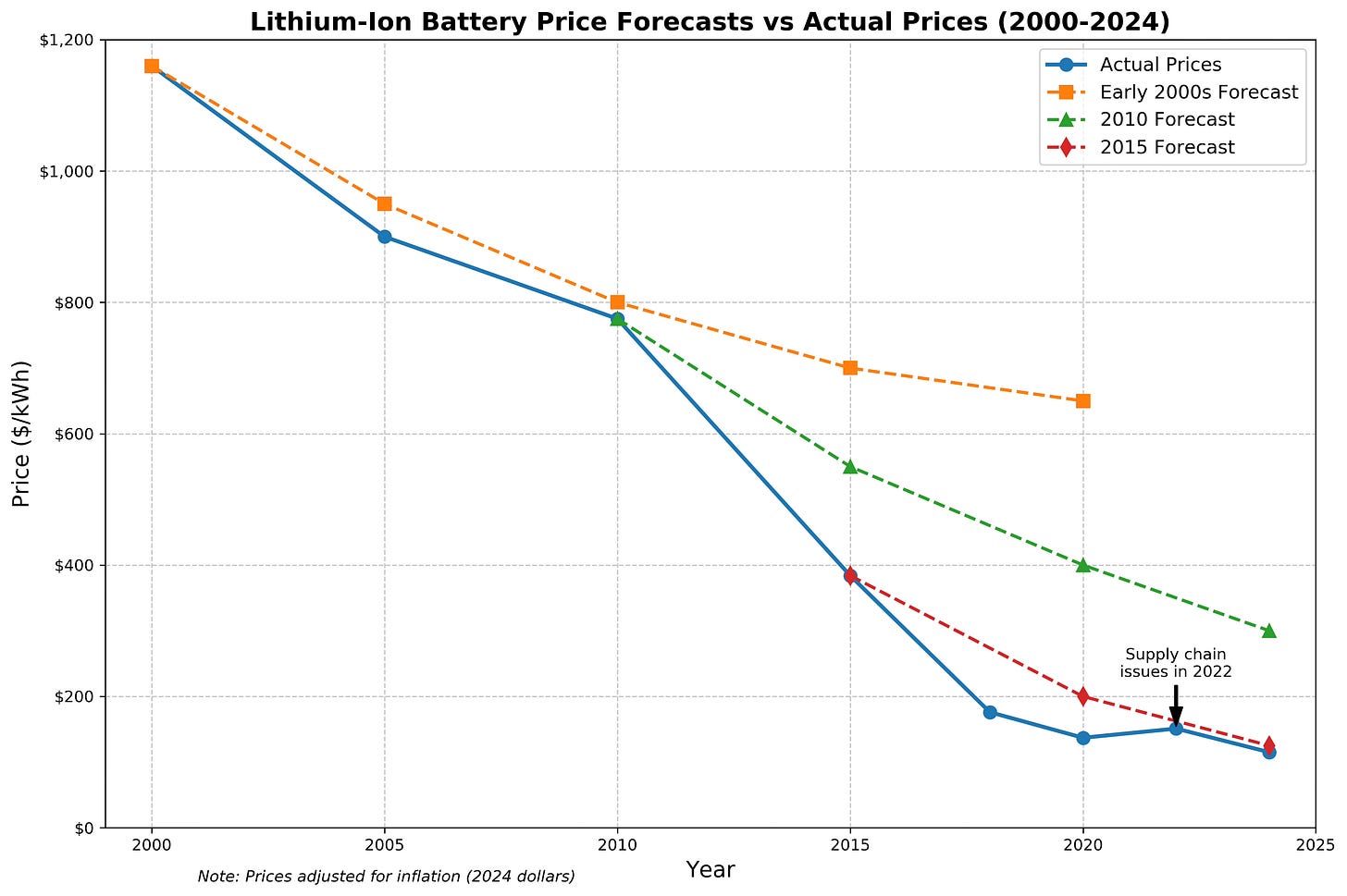

I found it interesting to compare general battery price forecasts from 2000, 2010, and 2015 with actual price data:

This chart reveals how we have been systematically too conservative in predicting how low battery prices can go for decades. In fact, we are so poor at predicting our battery manufacturing prowess that even a 2019 MIT research paper underestimated 2025 battery prices, declaring that there was no way battery prices would fall below $143/kWh (see 2024 prices in the first chart). This is not a dig at the authors but an illustration of our consistent inability to grasp technology learning curves even as they unfold.

To the authors’ credit, they did advocate for moving away from using minerals like nickel and cobalt to reduce battery prices, which is exactly what occurred. These metals form the cathode of NMC-type batteries, which were the standard EV battery type in 2019. However, since 2019, EV makers have shifted away from NMC to cathodes made from lithium iron phosphate (LFP) partly because lithium and iron are more readily available. This single move unlocked significant cost savings and has reduced an EV’s environmental footprint. Also, the authors’ concerns around high metal prices did not materialise, with lithium and cobalt prices being at and below at their 2019 prices (inflation-adjusted) respectively.

Looking ahead

Raw material prices and other fixed costs limit how low battery prices can go, and it appears we will hit an absolute price floor between 2030-2035. Some industry experts warn that we may currently be experiencing a global battery oversupply driven by increased production from China (which today produces 70% of all EV batteries — check out this IEA report). This will invariably trigger a temporary cyclical fluctuation in battery prices as short-term supply exceeds demand.

I can’t predict long-term battery prices but am confident that batteries will be too cheap to ignore by 2030. Barring any unforeseen supply chain shocks, it isn’t unreasonable to expect sustained sub-$100/kWh pack prices within a year or two. And $100/kWh is the magic number because EV manufacturers consider that to be the break-even point, below which EVs will be cheaper than conventional vehicles without subsidies. This also means that batteries will become even more affordable for households and industries to purchase for home/commercial energy storage systems. In fact, many large energy consumers and electric utilities are already replacing natural gas peaker plants with battery storage systems3. The future of energy systems arrives slowly, and then all at once.

The fact that we have been able to consistently outperform our own estimates of battery production is utterly remarkable. Witnessing a learning curve in action feels both exciting and unnerving to me. It feels surreal to have a quasi-deterministic outlook on battery production, but I find it comforting to know that we have figured out how to keep the pace of production steady for so long, despite everything going on in the world. It never hurts to be an optimist :)

Battery price trends from https://ourworldindata.org/